-

- Trading Platforms

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

-

- Trading Conditions

- Account Types

- Spreads, Costs & Swaps

- Deposits & Withdrawals

- Fee & Charges

- Trading Hours

ETH, H4:

Ethereum has come under renewed selling pressure on the chart after failing to hold above the 3,050 resistance zone, which has acted as a ceiling for multiple attempts throughout the past week. The latest rejection triggered a sharp downside move, driving price back into the 2,900 support level, an area that previously provided a floor during mid-November consolidation. This pullback places ETH back within its broader descending structure, as the recent recovery attempt was unable to break the sequence of lower highs that has defined the medium-term trend.

Momentum indicators confirm the shift in sentiment. The RSI has plunged from near 60 straight down toward the mid-30s, signaling a sudden loss of bullish momentum and indicating that sellers have regained short-term control. Meanwhile, the MACD has rolled over, with the signal lines now forming a bearish crossover and the histogram turning negative, marking a clear deterioration in momentum after last week’s slow grind higher. This combination suggests that ETH may continue to face downward pressure unless a strong reaction emerges at current support levels.

For now, the technical outlook leans bearish in the short term, with the breakdown from 3,050 reinforcing the broader downtrend structure.

Resistance Levels: 2930.00, 3050.00

Support Levels:2780.00, 2605.00

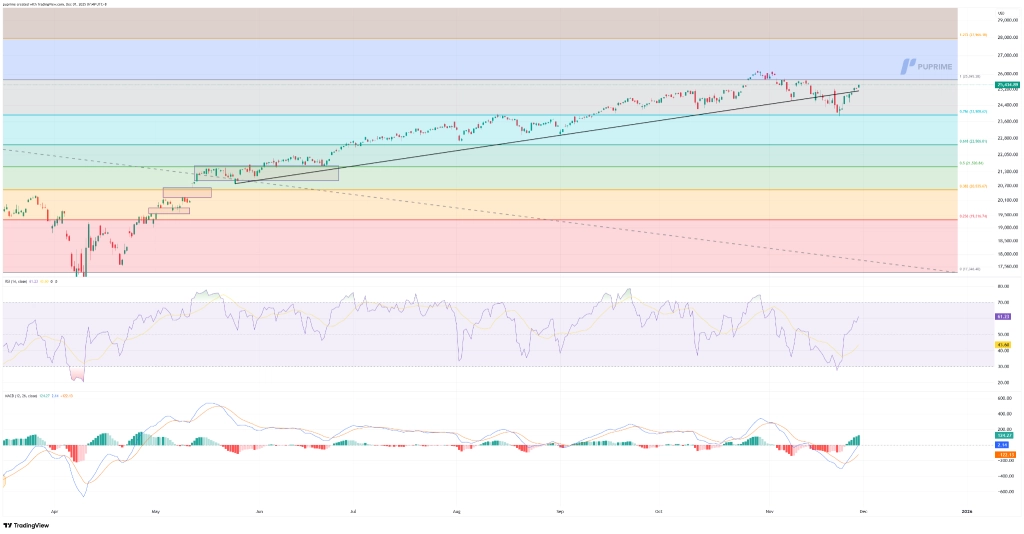

Nasdaq, H4

The Nasdaq has reclaimed upward momentum on the chart, rebounding strongly from the recent pullback into the 0.786 Fibonacci retracement zone, where buyers stepped in to defend the broader bullish structure. Price has now climbed back above the ascending trendline that has guided the index higher since early summer, signaling renewed confidence after last week’s corrective phase. While the market has not yet revisited the prior swing high near the fresh all-time-high region, the current recovery suggests that bulls are attempting to reassert control.

Momentum indicators support this constructive tone. The RSI has surged from oversold territory back above 60, showing a clear shift toward bullish pressure, although not yet into overbought conditions, which leaves room for further upside. Meanwhile, the MACD has crossed firmly into positive territory with expanding green histogram bars, reflecting accelerating upside momentum that aligns with the broader rebound in price action.

However, with the index now approaching a heavy supply zone overhead, traders should monitor whether momentum can sustain this push or if another consolidation phase emerges before a potential breakout. For now, the Nasdaq remains in a structurally bullish posture, supported by rising momentum and strong reaction from key technical levels.

Resistance Levels: 25,700.00, 27,970.00

Support Levels: 23,900.00, 22,500.00

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!